Health Insurance

We focus on excellent customer service through client education and empowerment.

ThruCore will guide you through the process of finding quality health insurance that suits your needs. This service comes at no cost to you. Qualifying for coverage is only one part of the equation.

Understanding how to access and use the benefits is the other. We don’t just show you what to do, we educate you so you can do it yourself.

During your FREE initial consultation, we’ll go over your circumstances, your needs, and your budget, to find options that will work for you.

Click here to Find an aca plan today

Health Insurance that suits you

If you’re on the market for health insurance, let ThruCore Solutions guide you. The below most popular asked questions can help you to understand what options you have when it comes to affordable care act.

WHEN CAN I APPLY FOR INSURANCE COVERAGE?

OPEN ENROLLMENT for private insurance sold off the Marketplace exchange and on the Marketplace exchange follow the AFFORDABLE CARE ACT guidelines.

When Open Enrollment is closed, they are open to individuals experiencing special circumstances that allows them access to coverage example loss of coverage within a two month period.

Enrollment starts on NOVEMBER 1 of each year and ends December 15.

Coverage then begins on January 15 of the following year, typically with no exceptions.

WHAT ARE MY HEALTH INSURANCE OPTIONS?

As an Individual or a Sub-Contractor, who is not currently being offered health insurance through an Employer’s Group Plan have two major options available to them:

- Purchase insurance from any of the independent insurance carriers that offer health insurance.

- Unlike a typical group plan that offers assistance with the monthly premium, the full cost remains with the individual.

- These polices can be individual or family plan.

- Go to the State Health Insurance Marketplace to purchase your health insurance coverage.

- Some may qualify for assistance which helps to reduce the monthly premium.

WHAT WILL MY HEALTH INSURANCE COST?

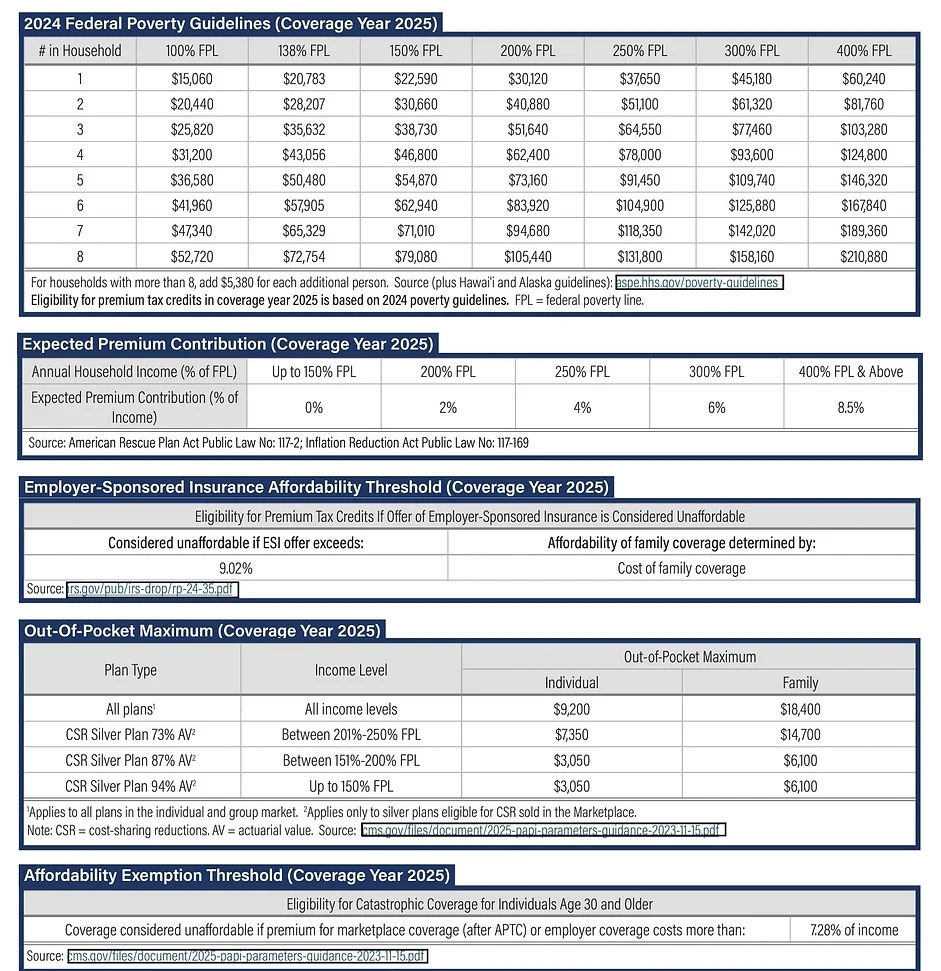

The Department of Health & Human Services (HHS) issues poverty guidelines that are often referred to as the “federal poverty level” (FPL).

Starting November 1, 2022, the Health Insurance Marketplace® will use the 2023 guidelines when making calculations for advance payments of the premium tax credit and income-based cost-sharing reductions for coverage year 2023.

top TEN questions we have answers to

Trying to understand all the moving parts of health insurance can be very frustrating and confusing at the same time.

Call us for the right answers.

- “What is a subsidy and do I qualify?”

- “What are the benefits?”

- “Can I go to any Doctor I choose?”

- “What is a SILVER OR BRONZE plan?”

- “What are the essential health benefits?”

- “Which ‘Metal Plan’ (Bronze, Silver, Gold, or Platinum or Catastrophic) meets my needs and budget?”

- “How do I navigate the Health Insurance Carriers Marketplace?”

- “What are the differences between deductibles, coinsurance, copayments, and maximum out-of-pocket costs?”

- “Is the lowest premium always the best choice?”

- “Are my current doctors within the network for the plan I want to choose?”

Federal poverty guideline 2024

The federal poverty level (FPL) is commonly used to refer to the federal poverty guidelines that HHS issues each year.

It’s specified as an income amount that is used to determine eligibility for various income-based public programs, such as Medicaid, premium tax credits, and cost-sharing reductions.

The specific dollar amount varies based on the number of people in the household and whether the household is in Alaska, Hawaii, or the continental U.S. The chart below is for the continental U.S.